Too Little? Too Large? Just Right? – Illustration, Tom Miller

Too Little? Too Large? Just Right? – Illustration, Tom Miller

One of the topics that comes up most frequently from our customers is “how much inventory should I carry?” Some solar contractors rely on job-site delivery and therefore carry no inventory of major components. Other companies stock weeks worth of product. And still others carry months worth, outsourcing job kitting and delivery to a third-party logistics company (3PL).

So, which is the best approach?

Having been both a solar contractor and a solar distributor, I have some opinions on this. (Shocking, I know.) My take is that this isn’t a one-size-fits all situation. So let’s review some of the factors that would inform a contractor’s strategy for inventory, including risks, market forces, and business choices.

Risks of having too much inventory:

1. Inventory valuation risk

Solar has been a falling-price environment for some time. 2012 is notorious for module prices dropping by over half, and 2016 again saw a precipitous drop. Given this market volatility, a solar installation company should understand that if it carries inventory, the value of that inventory might fall.

If the inventory is purchased for sold residential jobs, this is less of an issue as the sold jobs are typically contracted at a fixed price. However, if the inventory is purchased for jobs yet-to-be-sold, there is a risk of having to sell at a lower margin than expected. To mitigate this risk, inventory size should be based on backlog.

My 2 cents: In general, try not to buy more than you already have sold.

In the case of commercial jobs—especially larger ones—these can often be renegotiated by the buyer to reflect the new, lower equipment price. So even if a project is under contract, there is a risk of being forced to deliver it below the contract price.

In general, if you think prices will fall, try not to buy in advance for commercial projects that are not ready to start installing.

2. Liquidity risk (cash flow)

Buying inventory ties up cash in your business. If you have trade credit from your suppliers, it might not tie up cash right away. You need to not only deploy your inventory into jobs, but also bill and collect for those jobs before your supplier bill is due, to avoid tying up any cash.

Since you charge more for the product than you paid for it, there is a small margin of inventory that you can “cash flow” without installing it. However, given all of the cash burdens on your business—labor, insurance, vehicle costs, rent, etc.—you are better off sticking with the rule:

My 2 cents: “Don’t buy more than you can install and collect before the bill is due.”

Your supplier will doubtless have special offers from time to time that tempt you to break this rule, and sometimes they could be a good opportunity to expand your margins.

However, consider these opportunities based on how much your margin on sold jobs expands as a result.

Some questions you might ask are: “will the special offer enable me to pay my supplier in full, and on time, having installed fewer jobs to do so?”

Or: “If I use my bank line of credit to pay off my trade credit, are my credit line costs less than my increased margin?”

Risks of having too little inventory:

The risks of having too little inventory are less understood than those of having too much inventory.

One approach, made popular by Dell Computers, is the JIT (“just-in-time”) inventory management practice. JIT is an inventory strategy that entails receiving goods only as they are needed in the production process, thereby reducing inventory costs. This approach requires a high level of transparency throughout the supply chain to work. It should not be misinterpreted as “I can order at the last minute and magically expect the materials to show up on time.”

Solar is not ready for JIT (and we will be leading the charge when it is), and managing a contracting business based on last-minute deliveries gives the contractor less control. While this does eliminate inventory risk, it does introduce other risks:

1. Schedule risk

When working with homeowners, it is common for an installation schedule to be changed several times per week. This can be caused by external factors (for example, a homeowner suddenly being unavailable) or internal factors (for example, a labor overrun at one job makes it impossible to start the next one on time).

As we all know, changing on the fly causes errors and delays. If you rely on a supplier to keep up with these changes, you will need to be on the phone with them all the time and you increase the chances that you will not have the correct parts at the correct job at the correct time. Product availability, delivery route staffing and reliability, and supplier ability to navigate constant change are all factors.

Also included in schedule risk are change orders. If you have the opportunity to fit more modules on the roof than the proposal called for, being able to fulfill the change order from your own warehouse streamlines your ability to meet and even exceed customer expectations during the change order process.

To give you the flexibility you need to be in control of your schedule, let’s define a “set” of jobs as what you have on your scheduling board for the next two weeks. My rule of thumb here is:

My 2 cents: carry at least enough inventory to satisfy your next set of jobs installed in any sequence.

2. Risk of labor overruns

If you are relying on jobsite delivery, and due to traffic or any other delay beyond your control materials arrive late, you run a significant risk of labor overruns (e.g. spending more time on a job site than you intended). Idle time waiting for the correct materials or making a run to the supply house for a forgotten part is costly and distracting.

If your goal is to increase the profitability of your business through operational efficiency, these types of issues are the low-hanging fruit to eliminate.

My 2 cents: I would argue that if you are not striving for greater operational efficiency, your business is at significant risk. As product prices continue to drop, labor and overhead become a higher percentage of the cost of each job, and therefore more important to optimize.

It is true that you can mitigate this somewhat by paying your employees by the job instead of by the hour (check your local Department of Labor requirements for piece-work.) But this mitigating approach does not eliminate the problem altogether.

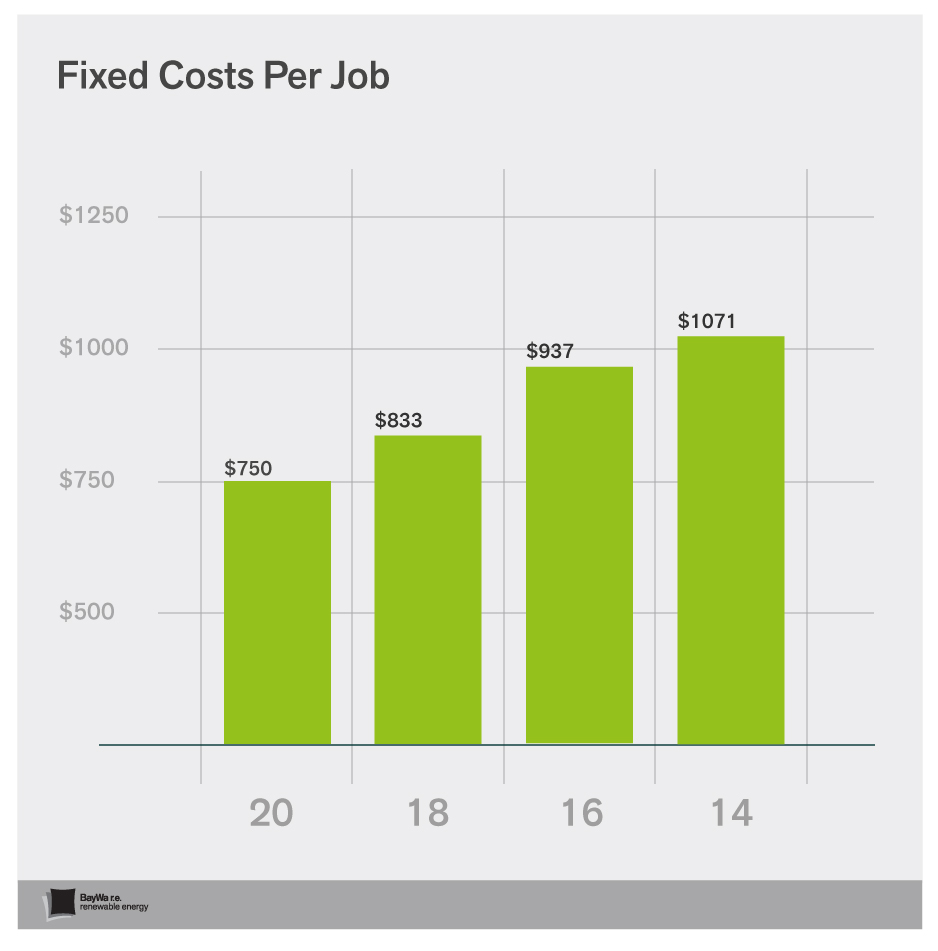

Remember, your business has “fixed costs” that occur every month regardless of how much you sell or install. So each labor overrun not only increases your variable costs (e.g. labor) for that job, it also increases the fixed expenses for that job (e.g. rent).

Another way to look at this is if you plan to install 20 jobs/month and allocate $750/job for fixed expenses, and you only install 18 because of labor overruns, you increase your fixed costs per job to $833. ($750*20 = $15,000, / 18 = $833.) This is on top of the increased labor you paid for the job. And it definitely doesn’t include the impact your labor overrun may have had on your customer’s satisfaction and the enthusiasm of resulting referrals.

To avoid the effects of labor overruns, staging (pulling the right project equipment for) each project in advance so that you control its timely and accurate delivery to the job site is critical.

Market forces impacting inventory decisions:

There are times in which certain market dynamics play a role in causing some risks to be more acceptable and prioritized over others. The most important is supply constraint.

Product availability

If product availability is going to be a significant factor in your ability to fulfill your contracts, you should consider increasing your inventory commitment for two reasons.

1) Not having inventory means you might not be able to install the jobs on your board, making it impossible to collect, and much more difficult to pay your employees. If you are concerned with market position, beware how quickly you can lose market share when a competitor is able to continue installing and you are not. Obviously, you need to keep installing, so you may want to increase your inventory level, sometimes even at the expense of short-term profitability (proceed with caution).

2) The less-obvious reason to increase inventory in a constrained market is that prices could increase. If this occurs, you may not be able to also increase the price of your sold jobs. In this case, you have the choice to constrain your cash flow or increase your debt by adding inventory, in order to protect your margins going forward. It might be a good idea to raise your prices a little on new jobs right away, if the market will bear it.

Technology shifts

If you intentionally overbuy in a constrained environment, another risk to watch out for is technology change, which occurs frequently in this industry. For example, if the market moves to a higher watt class and supply opens up, or the manufacturer of the product you bought goes bankrupt, you could be left holding too much old inventory. If this happens, look for a way to get rid of it quickly so you can focus on the future.

Market forces and supplier insight: Working in partnership with your supplier – as opposed to a transactional relationship – becomes very important when supply is unstable. In a supply constraint (a seller’s market), suppliers will prioritize reliable customers. Some suppliers will also take the opportunity to expand their margins or reduce their payment days, especially with more opportunistic customers. They will de-prioritize riskier customers who are less organized and pay less reliably.

Don’t forget that in the buyer’s market days you are cultivating a relationship with your supplier that will be critical for your business in the next product constraint. In a contracting market – or other circumstances in which supply might be excessive and prices falling – you might also define partnership with your supplier to include their willingness to re-price their open quotes and even un-shipped orders.

Business choices:

Products

The variety of products a business offers its customers can make inventory management more or less difficult.

Many solar companies determine that it is important to sell at least two options—one high-end and one “value.” Some also sell a “middle” solution, making a “good, better, best” option available to sales.

But consider: if you sell three different modules, and three different inverter solutions, you have nine permutations that you might need to pull off the shelf for a given installation. On top of that, one of your solutions might include string inverters, which, unlike micro-inverters, are sized differently for different sized systems. You can see how complexity increases quickly in relation to how many products you offer.

That said, depending on the needs of your customers, and what you feel you have to offer to be competitive, you may legitimately need to provide variety. However, the more you reduce your overall part count, the easier and more cost-effective it will be to keep the right parts in your warehouse so you can stage them with flexibility.

TIP: In the past few years we have seen contractors who previously offered a range of options standardize on one or two modules and a single inverter solution. These companies report cost savings in design, permitting, inventory storage, and labor as a result.

Planning

Perhaps the most important choice a business can make in relation to inventory management is to embrace planning. Too often a solar entrepreneur splits his or her time between installing, selling, and putting out fires, and rarely takes a step back to plan.

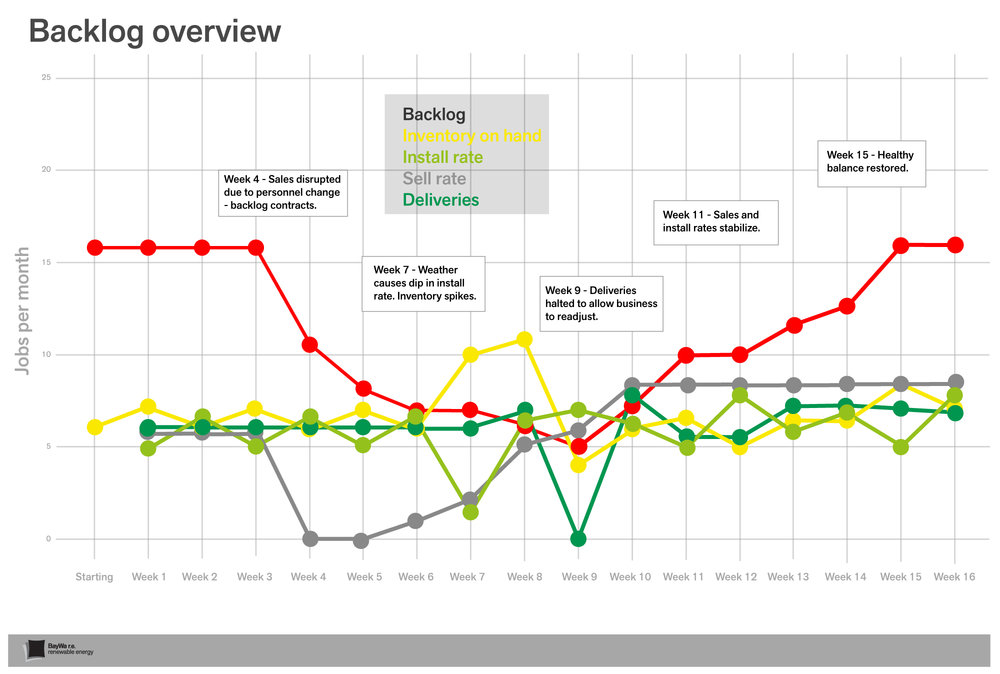

In order to make good choices and plan better about inventory, visibility into these metrics is useful:

- how much backlog (projects that are sold but uninstalled) is outstanding

- the rate at which the business is selling

- the rate at which it is installing

- how much inventory is already on hand? (you might be amazed at how often this is unknown)

The most important of these is backlog. Knowledge of backlog alone can prevent costly over-buying and promote healthy cash flow. With the right supply partnership, backlog information can be shared and used to make decisions together and plan inventory needs. (JIT Inventory Management done right depends on each stakeholder in the supply chain being able to forecast and use forecast data so inventory does, indeed, arrive “just in time.)

Watching backlog changes also gives insight into the sell rate and install rate. This helps inform decisions about whether installation capacity and sales and marketing activity should be increased or reduced.

Attempting to eliminate inventory often creates more complexity in the business and prevents profitability and growth. However, a dedicated inventory planning and management strategy, coupled with healthy supplier partnerships helps you eliminate many of the risks of carrying inventory and run a smoother and more successful operation.

We happen to have a few modules on hand from circa 2011-12 time frame. We keep them for possible failures for our clients. We just had an inquiry for 4 of them (from a non-client who had some stolen) and when I told them the price they laughed. I told them that pricing from that time frame was very different than pricing now. If they wanted modules to match what they had, the price is what it is.

Thanks as always for sharing your knowledge Boaz!

Thanks, Chad! And kudos for setting some modules aside for future use. That’s its own category of inventory risk, which I hadn’t thought of.