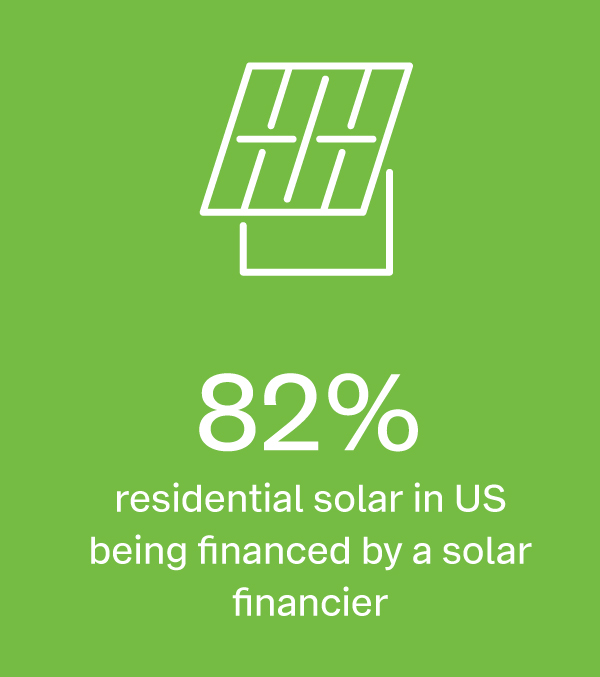

Solar financiers provide easy access to financing that is tailored for solar — in fact, according to Wood Mackenzie, more than 82% of residential solar being installed in the U.S. is financed by a solar financier. Much like car dealership models, solar financing products can take the form of loans or leases. But beyond that, the inner workings of solar financing may still feel hidden behind a curtain of mystery.

If you’re a U.S. solar installer who’s considering entering the world of solar financing, hit play!

Listen to our Director of Residential Financing Rachel Schapira cover what financiers are looking for in applicants, why they ask for so much documentation, and how to present your business in good standing. There’s much more to learn, but these 20 minutes will give you a foundation to start from. Listen on!

Podcast Summary:

Why installers use financing: “Generally speaking, it is a dramatically easier process for installers than what a homeowner has to go through to go out and get their own financing. And the truth of the matter is, in the U.S. we have a low consumer savings rate. So not a lot of people have large nest eggs — and people who have nest eggs are generally hesitant to part with them during a recession.”

How to determine whether to offer solar loans (financed through companies like Sunlight Financial, LoanPal, Mosaic, or credit unions and banks) versus solar leases or power purchasing agreements (PPAS): “Some homeowners are going to get the most financial benefit from loans, while others are going to get the most financial benefit from leases. It’s really about what type of financial product you as an installer wants to sell — and then start evaluating which financial companies that you want to work with. On the homeowner side, generally speaking, if someone has taxable income, they’re going to be really well served by a loan — because most solar loans are structured in a way so that the ITC benefit or the solar federal tax credit helps make the monthly payment of the loan lower from day one. But there are lots of people in the U.S. who have homes that are great for solar but don’t have a ton of taxable income — people on a fixed income, people on disability, people who are retired. And those folks are generally best served by third-party ownership, such as leases or PPA’s.

Preparing to partner with a solar finance company: “It starts with an application. The finance company is going to want to see your business details like financials, contractor’s license, maybe bank statements — all sorts of different documents that speak to the financial position of the installer. And then they’re going to do some additional research on you that goes on in the background. And if your solar business meets their underwriting criteria, they will onboard you — access to the platform to be able to run credit, where homeowners can sign loan documents if they pass credit. The finance company can run things all the way through the installation and disbursement process; when the system is installed and gets permission to operate (PTO), the funding gets paid through directly to you, the installer.”

The intangibles in getting approved by a financing company: “I think it’s actually really important that installers understand what’s going on. The main thing financiers check for during their underwriting process is whether your company in a financial position to be around for the long haul — because the they need to know that your business can honor any warranties or any promises they make to their homeowners. They also want to trust that you’ll be in business long enough to take all their projects to PTO — that homeowners are not going to be left holding the bag. That’s why they ask for all those financial records.”

Your quality of work and reputation matters: “Financiers also want to know is there some way they can assess that quality craftsmanship is being done. If the work is not being done well, the homeowner’s not going to be happy over the potentially 20- or 25-year-life of their financial agreement with the financier. Installers might be used to the usual customer relationship where you go through the sales process, you go through the permitting process, you get the system on the roof, you get it interconnected, and you move on, and maybe you hear from customers again with some service issues or referrals. But the lenders and lease companies are going to have 5-, 10-, 15-, 20-, or 25-year relationships with these homeowners. So financiers are going to make sure that installers are doing good craftsmanship. That’s why a lot of them will ask for contractor’s license — because most state licensing processes have a way to process complaints or a way to process issues, so that financiers have visibility when problems arise, or foreknowledge if a contractor has bad marks on their record.”

“Solar financiers are going to want to see online reviews, and that you’ve completed a fair number of installations. A popular number with a lot of solar financers is anywhere from 75 to 100 projects completed over the lifetime of your business.”

Rachel Schapira, Director of Residential Financing, BayWa r.e. Solar Systems

Experience matters, too: “Financiers are going to look for businesses that have been around a year or two, because generally speaking people that can keep their company afloat for a year or two have worked through their hiccups and lessons. They’re going to want to see online reviews, and that you’ve completed a fair number of installations. A popular number with a lot of solar financers is anywhere from 75 to 100 projects completed over the lifetime of your business. They want to see that you’ve gotten through a good number of systems all the way to the finish line — that you have many jobs done well, you’ve figured out how to navigate the utilities, and the AHJ’s (authority-having jurisdiction) in your area.”

Keeping your finances in order: “Financiers may ask to see bank statements. Generally speaking, they’re going to want to see that you keep two to three months’ worth of your operating expenses in the bank — your way of showing that you can weather a temporary downturn and keep your doors open and your employees paid. So, having some money in the bank is a good way to show that you’re going to be around for the long haul. The finance companies are generally going to want to see insurance also — workers’ comp — because lawsuits can completely sink a company if you don’t have insurance or workers’ comp.

Financiers are willing to listen: “A lot of the solar finance companies will have paths for young companies to get through and meet their requirements for stability. Suppose you’re a solar arm or offshoot from a roofing company or an HVAC company: if you can get your parent company to cross indemnify your solar business, that could be a path to come overcome a financier’s requirements. If you’re a solar veteran who has been in the industry, managing crews a long time, and you just started your own shop after always dreaming of starting your own business — and you learned how it’s all done working under another company — you may be able to overcome some of these minimum-install requirements. Different lenders and financers will have different kinds of ways to make sure that, again, homeowners are going to be protected and have good quality work done. So, talk about your situation, explain your track record, and explain your work.”

What to do if your company is too young to qualify: “I would definitely recommend reaching out to your local banks and local credit unions. A lot of banks and credit unions — given the great performance of solar financial products — are interested in getting in to solar financing. Credit unions and banks might be a little bit more cumbersome to work with than solar-specialized finance companies, but they can empower younger installers to sell on a monthly payment, and get through enough business until they finally qualify for solar finance companies.”

“Solar is a very cash-intensive business to get all the work done, so making sure that your books are being managed properly is going to help your business survive the ups and downs of the solar coaster and get you on stable footing to qualify with a solar financer.”

Rachel Schapira, Director of Residential Financing, BayWa r.e. Solar Systems

Be prepared: “Installers should get their financials done by a professional accountant. A lot of people do their own bookkeeping at startup companies, but having a professional bookkeeper or accountant look at your books is a great way to make sure that you are managing all the expenses. Solar is a very cash-intensive business to get all the work done, so making sure that your books are being managed properly is going to help your business survive the ups and downs of the solar coaster and get you on stable footing to qualify with a solar financer. And start building your online reputation. A lot of people don’t realize that even if you don’t have a website yet, you can go into Google maps and claim your address as a business and have a place where people can start giving you reviews. You can get reviews on Yelp, on EnergySage, on Better Business Bureau. Building your online reputation will help you with customer acquisition — because you may not realize it, but before you meet with homeowners, much of the time they have already Googled you. And if you don’t have a web presence, that might give them pause and it might be hurting your ability to close customers. So, investing in your online presence will improve your close ratio and it will improve your ability to get solar financing.”

Words of encouragement: “I hope that me showing you what’s going on behind the financing mystery curtain doesn’t leave you afraid to apply for solar financing! If you’ve been in business more than a year, if you have a little money in the bank, and you’re doing 15 installs a year — there are a lot of solar financers who’d be very happy to talk to you. It’s not that difficult to get in. And now that you know what goes behind the curtain, you can understand why a company’s risk team or underwriting team might be taking a while to review you. It’s not arbitrary or asking for random or unfair things. They’re just trying to protect their homeowners.”

Rachel Schapira is Director of Residential Financing with BayWa r.e. Solar Systems. She has worked in energy and technology management for more than 15 years, joining us in March 2020 from Mosaic.

BayWa r.e. Solar Distribution supplies residential and commercial solar installers in the United States with quality solar + storage components, forecasting, business planning advice, and a community of experts. Visit www.solar-distribution.com to engage with our team, read our industry insights articles, and stream our Solar Tech Talk podcasts and recorded webinars on YouTube and Spotify. Follow us on LinkedIn and Facebook to stay connected. Ask us about our Financing Program and use our industry-leading Webstore to save time, get gear shipped, and get jobs done!

Part of the BayWa r.e. Global family of renewable energy companies.