“Complete Solution” Journey – Illustration, Tom Miller

“Complete Solution” Journey – Illustration, Tom Miller

Editor’s note: This interview has been edited for clarity and length.

Tom: (Tom Miller – Creative Director, BayWa r.e. Solar Systems; Editor – Solar r.e.view): Hi Georg. Thanks for joining. And thanks for providing some notes on my questions before our call. Those were very helpful—and prodigious!

Georg: Well, I’m a recovering engineer [laughs]. I figured if we’re going to have a freewheeling conversation about a very complex subject… I’d better come prepared!

Tom: So let’s jump right in. What does the Head of Channels at Trina Solar do?

Georg: Historically, Trina has been—and continues to be—very strong in the utility and national residential space, but recent dynamics in our industry are driving the resurgence of the “long tail” installer. So rapidly decreasing equipment costs, combined with the rise of loans at the expense of PPAs and leases—those woke Trina up mid last year to this growing business opportunity. This is a segment of the market Trina had very little presence in previously, and they decided to make the necessary investments to get ahead of the curve.

So, essentially, I was brought in to build and scale the distribution routes to effectively access the small and medium residential and C&I installers that Trina, up to now, has almost completely neglected.

Tom: In your notes, you point out that solar is a construction business, which is inherently local. I understand your thoughts about the advantages of being a local contractor.

But as systems become cheaper and simpler, with shrinking margins and faster install times, do you think that the “solar-as-construction” analogy will hold into the future? Or do you think it will morph into something else?

Georg: Unless we see radical innovations in the application of solar cells to the roof—maybe in the form of solar spray paint applied by autonomous drones [laughs]—for the foreseeable future someone still needs to climb onto the roof and physically install panels. And someone has to wire the system. Even if it’s all plug-and-play, someone is still touching the load panel of the home.

So, for the next three to five years, I don’t see us radically disrupting the current form factor paradigm of a rectangular module, that needs some form of mounting hardware, that needs to be wired. So that makes it a local construction project. This will continue to be a sustainable competitive advantage for the small and medium “long tail” installer. And “cheaper and simpler” systems, at the end of the day, will translate into greater adoption and more customers.

Tom: As technology advances, and gets cheaper, what does that mean for contractor margins? Negative? Positive? What are the advancements that will help protect those margins?

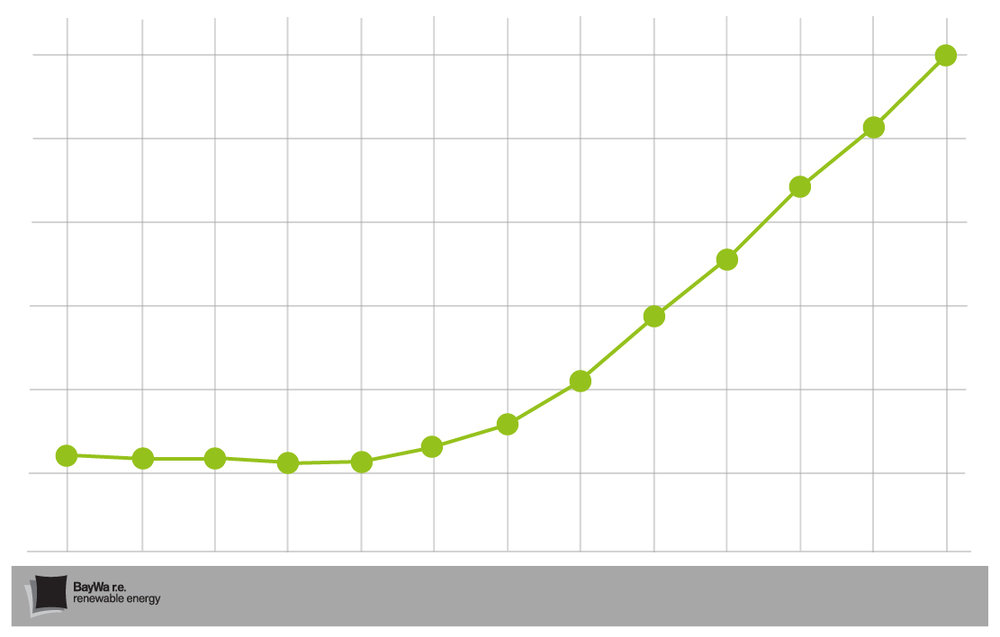

Hockey stick graph

Georg: The biggest hurdle for the industry to get off the short & flat section of the homeowner adoption “hockey stick”, and into the long and steep one, is cost. From a manufacturer’s perspective, we need to keep challenging ourselves to drive cost out of the equipment and to simplify its deployment.

I spent the early part of my career in high-tech, so the analogy that resonates with me most is the personal computer. In the early days, a PC was a significant investment for most households given its cost—picture an Intel 286 at $2,500—and recall its limited capabilities. But at some point the equipment got cheap enough to trigger mass-adoption and we now have a multitude of these computing devices, with vastly expanded capabilities, in many different form factors, all over the house. And now we can’t image life without them!

Tom: So where is solar now? In terms of your computer analogy?

Georg: In comparison to the cost reduction “road” we’ve traveled in high-tech in past decades—the squeezing out of any form of unearned margin from the value chain where no one (manufacturers, distributors and installers alike) gets paid for anything that doesn’t add value—solar is still in the early stages of this “journey”. There are still a lot of hands in the pie, a lot of inefficiencies, but this is an unavoidable Darwinian process that will sort itself out over time.

So once equipment gets cheap, simple, and capable enough, the economics of taking control of your energy future will become a no-brainer for the average homeowner. And the local installers will have volumes to install. Maybe at lower margins, but definitively faster, with less labor and at lower overall costs, driven by improvements and simplification of the equipment.

Tom: So what will consumers be purchasing in the future? In your computer analogy, people can now afford an incredibly powerful machine at a fraction of the price. If solar becomes so simple, what will dictate end-user choice? Or will we just be buying electricity, with no sense of the technology behind it? Like buying water?

Georg: Well, that’s what the national residential installers are selling today, right? They’re selling electricity fueled by various financial vehicles like PPAs and leases, primarily designed to monetize the 30% ITC tax credit for their investors.

They say, “Don’t worry about who makes the equipment that produces the energy. Or what the quality of this equipment is. Trust me, it produces electricity. I’m your new electricity provider, so don’t worry.”

This “zero down” approach works when you’re pitching homeowners that have less-than-stellar FICO scores. They might skip over reading a seventeen-page contract—which might not turn out to be financially advantageous for them in the long-run—for a whole host of reasons… But that’s a totally separate subject [laughs].

Pong – Image, Wikimedia Commons

But these types of sales models are enabled by relatively high system costs. But system costs will come down—like how the $2,500 PC you played “Pong” on evolved into the iPhone 7 over a twenty-year time horizon. As a homeowner, I can now afford to pay for the system outright, or take out a small loan. And I’ll definitely pay closer attention to who makes the equipment I’m considering for my home.

Tom: And that’s where your HVAC analogy comes into play… I’m reading your notes here!

Georg: [Laughs] Indeed. I think the way the HVAC industry goes to market represents an interesting blueprint for how the solar/storage industry might evolve—at least in residential: strong, national manufacturer brands, capable national distributors as supply chain partners, and a large network of local installers serving the end customer.

For me, like many average homeowners, my house is my biggest investment. It’s my biggest asset. And if I’m in the market for a new air conditioner, I’m aware of brands like Lennox, Carrier or Trane. I’ve been exposed directly to the manufacturer’s value proposition. And I know when something breaks, I can call an authorized dealer for service. So, in this case, I’m likely to gravitate to a manufacturer brand that I know stands for quality.

And depending on my financial situation—like with buying a car—I immediately know if I’m in the market for a BMW, or a Volkswagen, or a Kia. I know what product category I’m buying. And I have specific preferences about what I can afford and what level of quality and functionality I’m looking for.

Tom: As the technology becomes simpler will manufacturer brands start to mean more?

Georg: Yes. Going back to the computer analogy, if you take the example of the Intel 286 “white box” PC that I bought twenty years ago: if you went to your local “white box” integrator, you had to make decisions about the hard drive. What processor do you want? What monitor? You had to make a million decisions! Today you just pick up a box, plug it in, switch it on, and it works. You don’t ask which hard drive it has.

All of these component decisions, which are still front and center for the solar installer, they’ve been abstracted away from the customer over time. The closest parallel in solar I can think of is the AC module.

This year we’re seeing the first commercially viable AC modules, from a number of reputable manufacturer brands, available in volume. You will be able to take those modules, plug them in, and within a couple of years—at least for that subset of the residential market—no one will ever talk about an “inverter” again.

The 30,000+ white box builders, in the heyday of the Wintel period, they didn’t all go out of business. But those that survived had to seriously evolve what they were doing. Their value-add of assembling boxes went away.

But that’s the difference in solar. Someone will always have to attach physical panels and wire the system. But it might only take an hour instead of a day. And some manufactures will have abstracted away the inverter, and others will have different plug-and-play solutions, which might require less trained resources. But somebody still needs to climb up on the roof.

Tom: So if they’re just installing a simplified system, is providing the right customer experience going to be the big differentiator for the contractor?

Georg: Absolutely. The biggest cost for the national residential installers today is customer acquisition. For the local, “long tail” installer, if they’re growing smartly (by this I mean “organically”) their biggest sources of new business come from referrals—from happy customers. And again, here’s where the manufacturer’s brand comes increasingly into play.

Tom: We might also think of buying a car?

Georg: Yeah. If Bob tells his buddy John, “I just had a BMW system installed and I totally love it!” John will say, “Which ‘BMW’ dealership did you go to?”

“Oh, Steve at XYZ ‘BMW’ dealership helped me out—he was awesome. If you want the same experience, you should call Steve.”

If a local installer is able to serve their customer well, and the customer has such a good “going solar” experience that they’re inclined to recommend them to their network of friends, they’ve succeeded.

On top of that, decreases in equipment costs will help. System-level, integrated equipment will help. The decline in third-party financing. The increase in loans… These are all “tail winds” for the “long tail” installer. Pun intended [laughs].

Tom: When is solar going to be mainstream?

Georg: Well, we need to consider overall end-customer utility. What, as a homeowner, can I get out of this technology? If I’m only generating energy when the sun shines, with net metering I’m okay—my utility is reasonable. But if I’m in a time-of-use situation, my utility is not so great. So the next thing to consider is adding storage. Then I can peak-shave and time-shift. I’m moving toward an integrated system here. Moving toward a more managed system with greater utility.

Going back to the computer analogy—the white box PC you could play “Pong” on—the utility was minimal. With the iPhone 7, it’s exponentially higher at a relatively much lower cost. As manufacturers, we need to accelerate system integration—hardware and software. Solar-plus-storage. Consumption management. EV integration. Accelerate the complete solution. And keep making it simpler. Whoever does that best, wins the market.

The installer worries as little as possible about how the pieces fit together, can deliver maximum end-customer utility, and can leverage the same technology platform in as many different deployment scenarios as possible.

Tom: And then there’s cost reductions. Thoughts?

Georg: Yes. The price reduction curve for our equipment is giving all of us nose bleeds right now [laughs]. But, actually, radical cost reduction is the great enabler of eventual mass-adoption of a new technology.

There’s great innovation happening all across the technology spectrum in modules, inverters, racking, and storage. So the more we can reduce the costs of the integrated system, and combine that with greater customer utility, then you can get past the inflection point of the adoption “hockey stick”.

***

Bonus notes:

Tom: Alright. Big question. Where is the market headed—and need to head—for module-level power electronics integrated in modules to drive end-user adoption?

Georg: Well…

Editor’s note: Georg provided comprehensive notes to this MLPE question, which I moved here to reduce the size of this article.

***

Tom: Regarding your thoughts on MLPE—what you call the ongoing “battle royale” between microinverters and string inverters with DC optimizers—you brought up cost reduction. What specifically about cost reductions are related to functionality for the homeowner?

Georg: The most promising homeowner utility that is relatively new is the addition of integrated consumption monitoring. Right now, the electricity bill is a nuisance bill for many people. It’s ten pages long. It’s not high enough to go, “Holy cow!” And I haven’t bothered to educate myself about it. I might have a hot tub, a pool pump, a washer/dryer, an HVAC system—but I don’t really know what drives my electric bill.

Tom: So being able to see that all of that together, on a monitor…

Georg: Yeah. On a nice clean interface, let me show you how you’re using electricity. You’re cooling your house to fifty-nine degrees. You’ve got your hot tub continuously heated throughout the day, you’re running your washer/dryer during peak rate periods, etc.

If I’m a dual-income / no-kids-household, that’s going to be a different electricity usage profile than for a family of five with kids in the house all day. Once I understand my consumption profile, the key question is, what size of solar system do I really need?

Do I need twenty-five kW on my house to maximize generation? Or could I get away with ten kW, and add storage to time-shift? Then, overall, my system is x percent cheaper than the twenty-five kW to max-out the space on my roof, while providing the same utility.

In other words, do I just buy an ill-fitting suit off the rack without trying it on, or do I go to a tailor?

As a homeowner, I won’t know any of this until I have a consultative installer come to my home, analyze my usage, and custom-tailor an energy management system with the right amount of generation and storage that fits the usage pattern of my lifestyle. And, by the way, if that should change, here’s how we can make adjustments to that system over time to accommodate the changes in your lifestyle.

Tom: What is the one technological outlier that’s going to change everything?

Photo, Tesla Solar

Photo, Tesla Solar

Georg: Well, I think it’s about evolution not revolution. A lot of people have been talking about the Tesla solar roof recently. But just Google ‘BIPV’. That’s something that’s been around for as long as the concept of an AC module. You’ll come across a graveyard of folks that have tried it. But that doesn’t mean it’s not a worthwhile exercise.

The benefit for the “long tail” installer is that the Elon Musk effect—the excitement at the end-customer level about the electric cars and the rockets and all things “Musk”—acts as a “heat shield” for the rest of the industry, especially as we “enter the atmosphere” of residential energy management. It does raise customer awareness. It gets them interested. They see a Lamborghini and it gets them thinking that they might want a new car. And the local “long tail” installer can pitch them a BMW, or a Volkswagen, or a Kia.

Tom: There’s so much happening now in the industry. What filtering mechanisms can folks use? In your opinion, what are the most important things for contractors to pay attention to?

Georg: As an installer, I would rely on a value-added distributor to be my guide. A distributor—like BayWa r.e., with a long history of serving the “long tail”—has to make equipment vendor decisions for their customers all the time. And they’re spending a lot of time and effort to ensure they are aligned with the right manufacturers who are going to be successful. They continuously monitor their vendor network, they hear all the new vendor technology pitches, and are always researching new offerings. So I would align myself with a distributor who serves as my consultant in matters of technology selection.

Tom: On a scale of one to ten, what is an end-user’s perception of the solar industry?

Georg: Overall, I’d say…a five. But it’s a bit like having your head is in the oven and your feet in the freezer [laughs]. A ten on one side—for a person who’s had a very positive experience going solar. A zero for someone who got stuck in a lease or has a system that’s underperforming to what they were promised. So overall, it’s still lukewarm. That’s why it costs so much money to originate new leads.

We, collectively, haven’t done a good job of driving end-user utility to the point where the average homeowner says, “Of course! I need one of those!”

Tom: If you were new to solar, and didn’t know much about it, what information would you want from an installer so you were comfortable making that purchase?

Georg: Me, personally? I would appreciate an education on the different technologies. A minimally-biased education on my options. No high-pressure sales tactics. Be my consultant. Understand what my household needs. Lay out a couple of options with pros & cons. Then let me consider what you told me.

And then let me get back to you with any questions I might have. Let me move through the purchase process at my own pace.

Tom: Are solar shingles underrated or overrated by end users?

Georg: Currently overhyped and still unproven. If proven, most likely they’ll be limited to a small, affluent market segment for the immediate future. As a mass-market product that will replace traditional modules in the immediate future? Overrated.

Tom: In 2017: grow market share or protect margins?

Georg: From the installer’s perspective: protect margins. Grow slowly. Grow smartly. Grow locally. Even Solar City, now as part of Tesla, is stopping the door-to-door, “growth-at-any–cost” model. So, grow organically. And make some money while you’re at it.

Tom: Okay. Those are all my questions! Thanks so much for taking the time. It was great to talk with you.

Georg: Absolutely. You’re welcome!

TOU metering is the way solar has substantial benefit, if national energy policy were legitimate, not the other way around, as Georg suggests. Net metering fails to monetize the peak energy profile of PV; real TOU does. Most residential and small commercial PV would not consider off peak over production as a viable component of the ROI stream if policymakers would not allow utilities to subsidize peak buyers. Net metering does not disrupt utilities in any way, because the benefit, particularly as PV becomes more distributed, is becoming much easier to manage as an energy source. I say we should deregulate, and force TOU billing for all. Solar will become more valuable, as it displaces high cost utility provided power. The balance of production is not substantial, and will be largely consumed by the pv owner, in most cases. It is policymakers protection of utility monopoly that is the challenge.

"Thanks for your comment, Paul! I agree that valuing PV based on when it is produced, rather than simply that it is produced, provides a more accurate measure, and TOU does this. I am not sure Georg intended otherwise – there’s a little confusion in how he uses the word "utility" to mean both generically "usefulness" as well as "a regulated electricity provider." We’ll see if we can get some clarification from him. Thanks for reading!"

Good article. It endorses the way we’ve been striving to run our business, especially since grid-tie became prominent in 2001. Shared the link with all my associates.

And thanks for the lounge at Intersolar. That was such a nice way to interact with vendors. Kudos to your crew for making it all work so well.

Hi Antony, thanks for stopping by our lounge this year, and I’m glad you enjoyed it! And thanks also for reading and commenting.

@Paul: I completely agree with you that TOU metering is instrumental for distributed solar + storage to grow into its full, long-term potential. On the point I was trying to make, please do substitute "usefulness" for "utility" (My apologies for the confusion)

@ Boaz: Thanks for clarifying!

This interview does a good job of reflecting the views of solar-energy providers and business executives. But what if this was an interview of an end user, rather than a vendor? What if you asked these very same questions of mainstream homeowners; what would their answers be? Qualitative interviews of mainstream buyers show a VERY different view of product requirements: http://www.hightechstrategies.com/2017/07/25/majority-homeowners-arent-ready-solar/

Warren, I had just read your article – it will be in our next industry news feed. Thanks for reading and commenting! Hope all is well with you.

@Warren: Very much enjoyed reading your article that applies the “crossing the chasm” framework to our industry.

My attempt here at stepping into the homeowner’s perspective at a very high level, is that if you are defining value as the utility (sorry Paul & Boaz! … usefulness) that a customer can get out of a product at a given cost — even what you call the “core product” — is still far away from delivering the level of value to the average homeowner necessary to make mass-adoption a no-brainer.

Completely agree that the “augmented product” — the (integrated) core product from a trusted brand (… who will play the role of IBM in our ecosystem?) + standards/interoperability (especially in the broader context of the “smart home”) + ancillary services @ a given (minimized) cost — will be critical in driving the value of the solution to the “no-brainer” inflection point.

If you contrast the value (utility / cost) of yesterday’s Intel 286 PC with the value of today’s iPhone 7 — Take today’s solar system, as part of tomorrow’s residential energy management system, as part of a future holistic “smart home” (… fun to think about what that will look like in 20 years!) — we are still at the very beginning of a very exciting journey … for manufacturers, distributors, contractors and most certainly for the homeowner who will (hopefully) be the beneficiary of all of our efforts.

Working for a manufacturer, I’d love to discuss live at your convenience, what you think we can do to amplify the voice of the homeowner into the “Complete Solution” development to accelerate our joint march towards mass-adoption.