Illustration, Tom Miller

Illustration, Tom Miller

Today we’re chatting with James Coombes, manager of American Renewable Capital. James has over twenty years of financial advisory experience, and has been developing & financing solar energy projects since 2008. For the four years prior to the formation of ARC, James was responsible for commercial project financing for SunPower Corporation (SPWR), a leading solar panel manufacturer & project developer. From 2008 to 2011, he was responsible for commercial, municipal and residential financing at REC Solar (now acquired by SunRun and Duke Energy).

Editor’s note: James is available to answer any questions and help you jump into the commercial market. You can connect with James at ARC through your BayWa r.e. Solar Systems sales rep.

This chat has been edited for clarity and length.

Tom (Tom Miller – Creative Director, BayWa r.e. Solar Systems; Editor – Solar r.e.view): Hey James, thanks for joining me.

James (James Coombes – American Renewable Capital): Happy to be here.

Tom: So let’s talk about commercial financing! Where are we at? And where is ARC coming at it?

James: Well, there are some companies who have capital but don’t have the appetite for smaller projects—or anything less than A-rated credits. And then there are people who think they might want to finance smaller projects for non-investment grade customers but have no idea how to get the capital.

Developers should understand that owning financing, and owning and operating solar projects, is more than just building a business model on the back of a napkin and magically having investors show up on your doorstep.

Right now our industry is infiltrated by people who don’t bring capital. They go around and kind of bluff the parties involved in the hopes that capital will materialize.

When I came in to solar, my process was distinctly different from that. I was saying, “let’s look, and keep looking until we find the right people who can deliver and bring something unique.” The challenge is: you don’t just “start” a finance company. You need substantial capital; you need to know how to do credit; you need to do asset management; you need to have solid institutional relationships. You need to do a lot of “big company” things, but also maintain the hustle and flexibility of a small company so you can make credit decisions quickly, streamline your contracts, and solve one-off challenges for customers. And that’s what I’ve been doing at American Renewable Capital.

Tom: Okay, great. So how is the commercial financing approach different from residential?

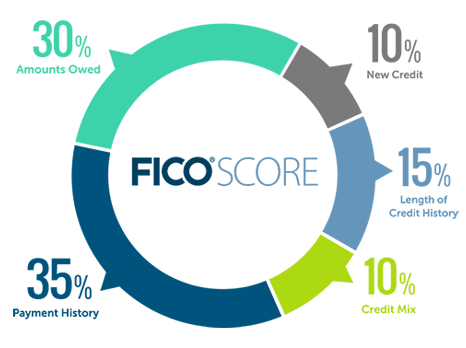

James: Let’s step back for a minute. Residential solar financing didn’t come first, but it scaled well. And it scaled for a very specific reason: residential homeowner credit is very straightforward to assess. Public sources of information, FICO Scores, home values, home equity.

Because there are so many homeowners with sufficient home equity and credit scores interested in solar, it created the opportunity—not without a lot of trial and error—in 2006, 2008, 2009. And it got to the point where you could invest large amounts of capital from investors who thought they were putting their money against large tranches of high-quality homeowner credit.

Tom: And that worked.

James: Yup. So great, that worked. But the reason commercial is different, is that the best candidates for solar are the companies with the ability to pay cash. Or they monetize the tax credit themselves and borrow money from existing bank relationships. So those customers are great for contractors. They’re already widely approached by the market. But they don’t need third-party financing, by and large.

Three problems

Tom: So now we’re looking at a subgroup?

James: Yeah. And I’d call this problem one. The customers who are asking for financing—because they don’t have the access to capital themselves—this group is not the top quality, top balance sheet, financial prospect for solar.

Tom: But how are you measuring quality here?

James: Well, it’s not necessarily quality but transparency that’s the issue, and here we run into problem two: it’s not obvious from just looking at a business what you’re dealing with. You can look at two hotels, side-by-side—with the same brand name and everything—and you have zero idea about who owns them. You don’t know how they’re financed, how long they’ve owned them, how debt-heavy their balance sheet is. It makes for an inherently uncertain process. This is in contrast to residential, where you have customers with FICO scores stamped basically on their foreheads.

There are some things you can do, which is what ARC does—and we can talk about that in a moment—but for the most part, you won’t really know what’s under the hood, financially, right away. So that’s a level of challenge.

Tom: So what sales challenge does this present?

James: Well, I think this is the final challenge or, problem three. This is when the salesperson might not know when to stop and say “no.”

They might have a customer who they believe is going to be a good credit—even though some financiers may have told them they might not be a good credit—but God, it’s such a good deal! And they keep pushing and pushing… But in those cases, they need to stop and focus on the next opportunity.

Tom: It sounds like in those cases, the customer as well might not have the best understanding of the process.

James: Definitely. And that’s where we need to have a dialog. With the segment ARC approaches, the probability of credit approval is quite high. But there are still customers where we need to say, “you know, you might need to downsize this a little bit, so it’s proportionate with your financial strengths.”

Still, customers often say, “No. No thanks. I’ll keep looking.” In those cases, they think it’s basically Lending Tree and they’re thinking, “Since this deal won’t work, I’ll just keep moving forward. There are multiple guys who will be beating down my door to finance this.”

Tom: Sounds like you’re talking responsible financing? [Laughs]

James: Well, you do have the guys who show up at your door—and they have the search engine ads, and blogs, and good online presence—and customers can end up turning down good advice and going with the false prophets who want to sign everybody up, and talk to everyone, and put you into one bucket.

And especially when you don’t have people with capital—maybe just investors looking to broker deals—you have a bad pairing. In that case, you have a customer who desperately wants someone to tell them, “Yes!” And you have this broker—all profit—who wants to say “yes” to everybody. And then all these contractors wonder, “Why have all these customers, or leads, had bad experiences with financing?”

Tom: That’s a bad progression.

James: Yeah. You have a series of people who have refused candid advice, pursued the wrong project, got teamed up with false prophets, and wonder why they have bad solutions

Tom: So is there a positive side to all this? [Laughs]

James: [Laughs] Okay, yes, I’ll contrast that with a positive note.

James’ rules of thumb

James: We know that investors with capital—like American Renewable Capital—are going to have very clear guidelines as to what kinds of customers they want, and what their credit criteria are. So the rule of thumb I give people is:

- you only want to deal with investors who want to see your financial statements first…

- and then, they only ask you to sign something at the END of the underwriting process—once you’ve been approved. You want to avoid people telling you to sign something first, and then say they’re going to figure it out on the back-end. And some people use different words and language for this, so you have to be careful.

- I’ll also say this: never sign a letter of intent. Real investors don’t need letters of intent. Does your mortgage banker ask you to sign a letter of intent? And then sit on your application for six months?

- People with capital know what they can finance. You don’t need to sign a commitment letter. A lot people sign a contract thinking they’re approved! Well, what that contract actually says is that they’ve got six months to go figure it out, and make sure all the other conditions have been met! Never do that!

Tom: So the quality investors will be up front with you?

James: Yeah. Investors that have money to put to work will be very clear about their customers, credit criteria, and will be the first ones who want to see your financials to make sure your customer can be approved. We want your dealers focusing their time on finaceable deals!

On a operational note: at ARC, we have very streamlined contracts because we’ve done lots and lots of deals. And we know how to make the contract very accessible for both investor and contractor.

Let’s talk quality development

Tom: So let’s talk about development. What are contractors not considering on the development side in terms of commercial projects?

Solar carport construction – Photo, Run on Sun

Solar carport construction – Photo, Run on Sun

James: The core thing I want people to walk away with—especially people in California—is that it’s okay to only do a certain amount of work to understand if a customer’s credit is going to work. But that’s not a substitute for doing no development work at all.

And what I mean by that is: there’s a tendency to do all thumbnail quotes: “I’m going to price all my deals at 2.75 a watt. All my performance levels are going to be the same.” And most egregiously, this is often done with no sense of the customer’s actual utility bill reduction. In markets where you have time-of-use charges and demand changes that can be really problematic.

Tom: Because those number can fluctuate a lot!

James: Definitely. We get a lot of deals in New York and New Jersey, where people are calling me up and telling me, “My customer is going to save 20 cents a kWh.” Well, by and large that’s not the case in those markets. You need to check.

Energy Toolbase is an excellent utility rate analysis tool. You can feed the customer’s data in, and it can parse through seasonal charges, demand charges, and show you the customer’s actual solar-driven utility cost reduction.

Tom: And that goes back to transparency. Having the customer understand what they’re getting into.

James: For a customer to understand the financing value proposition, they have to understand 1) how much the system is going to produce and 2) how much it’s going to reduce their utility bill.

We’ve seen a lot of proposals where people lay out projects with panels under trees and on bad sides of buildings. We see performance mis-overestimated consistently. We’ve seen utility saving rates overstated consistently.

Tom: Slap-dash development work.

James: Yeah. That’s a product of moving too quickly. In California, we see such consistent quality proposals that when the really bad ones come in it’s very obvious. Especially when they’re coupled by a salesperson who says, “This customer is ready to go. They just need financing,” It never works that way! There’s never a deal that’s just, “Ready to go and just needs financing.”

Financing is an inherent part of the development process. And a customer who hasn’t figured out how they’re going to pay for a system—they might have selected a contractor because they have a relationship with them—but they haven’t said, “Yes,” until they have the financing.

Tom: So who are the customers who are ready?

James: Well, I’ll just list them off: the customer who shares their utility bills. A contractor who has done a thoughtful and reasonable layout. A utility bill analysis and a reasonable performance analysis. And ideally—another key point—if a customer is really ready to go, the customer should have provided their financial statements or should be ready to provide them, to a financing partner on notice.

The customers who aren’t ready to provide their financials aren’t ready to go. Those customers are shopping around. They’re researching, but they’re not ready to go. In a situation like that, candidly, you simply have a salesperson with a hot lead. That’s not a customer who is ready to go. That goes back to quality development.

Tom: And there’s the question of, “Is this customer ready to own solar?” Do they understand what it means to own the system?

James: How many times has a contractor reached the end of the process and the customer says, “Are you going to guarantee me the performance levels?” And that’s a fair question.

The contractor who has properly built the value proposition, and who has a customer who understands solar, is going to understand that while performance is highly predictable there are are some major sources of variance. These can include soiling and shading, among other things.

The contractor whose customer can say, “Yes, there is going to be some variance around a certain performance number. And part of owning solar is not knowing how many days the sun is going to shine a year. But I’ve picked a PV and inverter manufacturer who I trust, and whose warranty I trust. And I picked an installer with a good local reputation, who I trust will be around, and who will honor their workmanship warranty.” That is a customer who is ready to own solar.

Of course, for a non-profit, we are going to have a PPA where they’re paying for actual production. But it’s the customers who understand, and are comfortable with solar, who are going to be pushing to sign a contract, hustling to get it built, and the most satisfied with the result.

Tom: That sounds like a good sales process as well. So let’s turn to projects.

Tom: What is a quality, qualified project? What’s a qualified project look like?

James: First, that varies state by state. Every area is going to get a different level of performance. And every area is going to have a different utility rate structure. In California, a customer’s blended utility savings is in the mid teens to the mid-twenties. 15 cents to 25 cents a kWh. You go to Arizona, and you’re looking at maybe eight to twelve cents if you’re lucky. And you go to Texas, you’re all over the map. The lower the utility savings rate—the eight, nine, ten cents a kWh—you inherently have to have lower installation prices to make those projects work.

Then there’s system price and performance. A two-dollar-a-watt system in Arizona works a lot better than a two-dollar-a-watt system in Ohio because you’re cranking maybe close to double the performance out of every module in Arizona.

But conceptually, the contractors should understand that—outside of California—the days of three-dollar-a-watt system pricing are gone. And frankly, the days of sub two-dollar-a-watt system pricing are here. That’s not on every 25 or 50 kW system, but I think one of the biggest developments we’ve seen in the past six months or a year, is seeing that two-dollar-a-watt and sub two-dollar-a-watt price point outside of the southeast.

Tom: Okay, so we have our outputs now? What’s next?

James: So once your quality outputs are prepared, then you’re in a position to talk to a financing company in order to understand whether that deal is going to A) pencil out economically and B) whether that customer’s credit is going to work.

If I get someone from New Mexico or Dallas that sends me a proposal and says, “Look, here’s where I’m going to put my modules and here’s my performance simulation,” that’s great.

With a good layout and performance simulation, and a good utility savings analysis, I can help give you a target zone to be in to build that system.

Tom: And what sort of project are we talking? Do you specialize in any particular type of project?

James: If I see a well-developed project, with a company that’s either already provided financial statements, or is within one of my specific sweet spots—like private schools or houses of worship—then I can give very direct feedback. I can say, “Hey, this project has to be $2.10 a watt in order to pencil out for the customer. Can you hit that?” The contractor or salesperson should be able to say “yes” or “no.” And if the answer is no, then put the deal aside.

And I’m not trying to tell anyone that I’m the only solution out there. I recommend that people work with well-established financing banks like Wells Fargo or Key bank. In fact, if you’re a good candidate for Wells Fargo to advance you, if you’re a Wells Fargo corporate banking customer already than they’re really the only answer for you. My pricing, my ability to finance that, is not going to be anywhere close to what Wells Fargo can do.

Talking about rates: the real challenge is when a developer gets comfortable with the Wells Fargo rate structure—and this happens all the time!—and whenever a rate is higher than that they say, “Wow, that’s expensive.” Well, not really.

Tom: Because of the difference in lending rates?

James: Yeah. People with 800 FICO scores borrow at different rates than people with 600 FICO scores. And the same applies with commercial. We have a corporate rating system that’s existed for decades. But it’s the guys who are off that credit rating scale who need financing.

There’s nobody out there who’s right for every deal. And people who say they are is intentionally misleading the customer or contractor. The smaller private companies and non-profits—the ones who need financing—need investors who really understand which sectors to approach and which sectors they’re not going to be competitive in.

Tom: Are there rules of thumb for contractors when working with a financing company?

James: People should tell you what their strike zone is and give you a direct line-of-site. They review your financial statements, credit approve you, get contracts signed, and commence funding.

Some contractors get nervous because a process like that forces them to say how quickly they can actually execute and whether they’ve done a project of a certain size before. But for the quality contractors out there, that’s exactly what you want.

But really, you want a finance person who is going to do their job and get out. They put it right back in your hands so you can control the customer experience, build the project, drive the timeline. The financing should be more of a secondary thought.

Tom: So you’re getting out of the way? Is there a danger you’re alluding to?

James: You do not want financiers who are going to take control of the process and control your customers because, frankly, a lot of them won’t get the project financed at all. And if they do, they’re not necessarily going to treat you, as the contractor, fairly on the back-end. Once the financier controls the customer—and many contractors can relate to this—there’s a good chance of getting poorly or unethically treated.

Tom: Got it. So I want to start and wrap it up. But I want to ask, are there projects that are easier to address now than in 2016?

James: Let’s look at changes in the market over the last five years. Those are 1) string inverters 2) increased investor undertaking of solar and 3) the 1603 grant.

Five years ago it was all central inverters, larger systems, slow inverter replacement times. Big expense if your inverter went down. This made people nervous. So with the prevalence of the string inverter, there are many more projects out there. And part of the fuel for that was the 1603 grant. Which, even when it wasn’t there, enabled a lot of things to happen. Taking the tax credit out of the mix, it actually made structuring financing simpler and opened up segments that weren’t previously financeable at any scale.

In our case, it opened up non-profits. Because as a non-profit you can’t do a lease. So even though the 1603 grant is gone, it enabled some smaller projects and different types of credits to get funded. And once people saw those, they effectively became de-risked and we had the ability to do some smaller systems and got really comfortable with it.

So now we’re willing to do PPAs for 50 & 100 kWh projects. Which is why I call out churches, synagogs, private schools, and homeowner’s associations, for example. Once the 1603 went away, companies like ours said, “We need to evolve, and do more PPA financing to target customers like that.”

Tom: Okay. Last question. What projects should contractors be going after and what can you do to help get these projects done?

Jim Jenal (CEO, Founder, Run on Sun) on school roof – Photo, Run on Sun

Jim Jenal (CEO, Founder, Run on Sun) on school roof – Photo, Run on Sun

James: So right now we’re doing a lot of 50-200 kW schools and houses of worship. We have a contract that goes out to the contractor and they work with the customer. They’ve probably screened the customer with me ahead of time. And ARC can tell four out of five times—just from the location and looking at the property and knowing the history of the school or church—its probability for credit approval.

So, essentially, we’re taking that mystery that we talked about away. When you’re working with ARC, there are a half-dozen non-profit sectors that effectively have their credit liability stamped on their forehead. We can tell from our experience working with similar institutions whether we’re going to credit approve them or not. So we can give the contractor or salesperson a good sense if they’re using their time effectively.

Tom: What are the most successful contractors doing?

James: The best contractors go out there and develop their own marketing campaigns. Maybe targeted at residential customers who have kids in private school. Or target houses of worship. Or health care, fire associations, labor unions, credits unions. I keep mentioning houses of worship because of the sheer numbers. And I should say, a lot of those have a mission-driven reason to want to do sustainability projects. So when you couple the prevalence of those customers with high approval ratings and their desire to do that type of solar project, that is fertile ground for investors like us that can finance those projects quickly.

So if you can meet the parameters that we talked about earlier, I can quickly provide you a financing proposal and I can tell you if financing is going to work and if credit is going to work.

Tom: Okay. Well those are all my questions. We took quite a dive! But this has been very informative. Thanks so much for taking the time.

James: No problem. Happy to do it.

Editor’s note: James is available to answer any questions and help you jump into the commercial market. You can connect with James at ARC through your BayWa r.e. Solar Systems sales rep.