After a tumultuous year that pushed the industry into a decline in C&I PV installation, we are looking forward to a return to growth in 2021. In this article, we want to look beyond the present and discuss market perspective, upcoming product changes, and risks to be on the lookout for, to help you navigate competitive and market dynamics in the year ahead.

2021: Double-Digit Growth for Commercial PV and Triple Digit Growth for Commercial Storage?

After a year marked by the fall-out of COVID-19 and a devastating Q2, we anticipate meaningful double-digit growth for the C&I PV market in 2021. This is largely due to a surge in demand from corporates, a recovery in the permitting delays that have plagued the industry in Q2/Q3 2020, and a spill-over of installations from 2020 into 2021. A poll sample from some of our EPC partners across the country indicates an anticipated growth of about 30%, in line with industry leading analysts who forecast 30-40% growth in MW installed year-over-year.

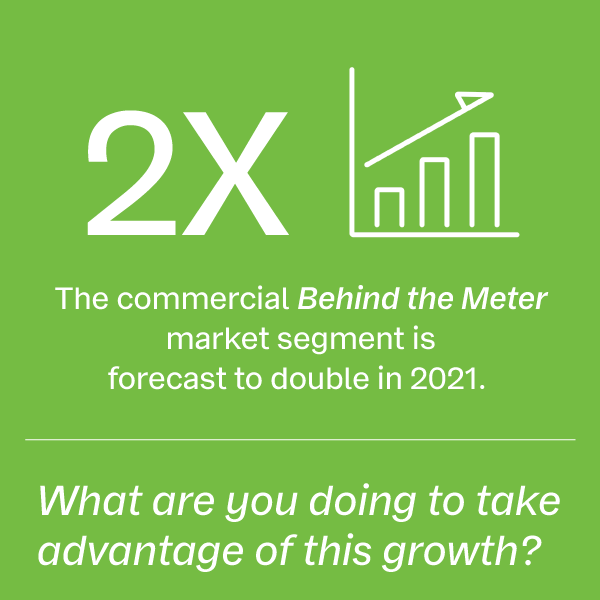

Behind the Meter commercial storage applications are forecast to double in 2021, from 292 MWh of capacity installed in 2020 to 593 MWh. This growth will be concentrated primarily in California, New York, and Massachusetts. States like Arizona and New Jersey are also expected to begin contributing meaningfully to demand. If you are an EPC partner operating in these states and want to learn more about storage, we invite you to read our previous article, check out our commercial townhall or, send us a note!

2021: Anticipate a Panel Form Factor Change

We advise our EPC partners to start incorporating larger module formats in their proposals for commercial solar applications as module form factors will go through an evolution in 2021.

Whereas most Tier 1 watt classes sit around 405/410W today, we will witness an initial form factor change as soon as Q4 2020, with Longi 440W modules already arriving at our warehouses. (Give your BayWa r.e. Solar Systems representative a call to learn more.) Like all new product releases, the initial roll out will be gradual and may take some time as manufacturers work out their supply chain kinks.

Around the second half of 2021, anticipate another size increase as our partners such as JA Solar and Trina Solar start to leverage 182mm cells to release modules in the 550W power class range and up! We anticipate a strong adoption of these modules as they will generate savings. WoodMackenzie estimates the Capex savings to be up to 9%, thanks to a lower BOS BOM. Nonetheless, we invite our EPC partners to carefully do their homework on cost savings as these estimates may vary on a per project basis.

“JA Solar is at the forward edge of the industry to bring the larger format modules in volume.”

— Thomas Nielsen, JA Solar

SolarEdge is releasing a P950 in November 2020 and should be releasing the NEC 2017 compliant P960 in Q1 2021. SMA has yet to announce a timeline for the V2 (current version clips at 420W) of their JMS Rapid Shutdown unit. So, be sure to stay in touch with your BayWa r.e. Solar Systems representative to ensure you are designing future projects with the right products in mind. A mispairing of modules/MLPE may cost you system performance—or worse, render your project non-compliant in your local jurisdiction.

2021: Stay Prudent – It’s the Solar Coaster After All

While 2021 looks promising, it would behoove us to stay prudent as there are some clouds of uncertainty looming over from 2020. For one, the overall economic recovery from the fallout of COVID-19 seems to be stalling. This might affect the solar industry, as a depressed economic environment may slow corporate procurement and limit the pool of tax equity money available. Second, the health situation related to COVID-19 continues to create uncertainty. While solar has solidly weathered the storm through Q2 2020, installers should keep watch over public health trends as they relate to consumer behavior, employee safety, and further economic turbulence.

Lastly, we will be keeping a close eye on the political aspect of renewable energy industries and demand for commercial retrofits and upgrades. The results of the U.S. election in November may impact which way the wind will blow for our C&I segment and the solar industry as a whole.

Until next time, stay in touch with me at Guillaume.Casanova@baywa-re.com. Share what you’re seeing out on the commercial landscape with me and our #SolarFam!

Guillaume Casanova is Director of Commercial Solutions at BayWa r.e. Solar Systems (USA). He brings more than 12 years of experience in wealth management, market analysis, and renewables industry partnerships to our team. Contact Guillaume at guillaume.casanova@baywa-re.com.

BayWa r.e. Solar Distribution supplies residential and commercial solar installers in the United States with quality solar + storage components, forecasting, business planning advice, and a community of experts. Visit www.solar-distribution.com to engage with our team, read our industry insights articles, and stream our Solar Tech Talk podcasts and recorded webinars on YouTube and Spotify. Follow us on LinkedIn and Facebook to stay connected. Ask us about our Financing Program and use our industry-leading Webstore to save time, get gear shipped, and get jobs done!

Part of the BayWa r.e. Global family of renewable energy companies.