Grid, Storage, Acquisition! – Illustration, Tom Miller

Grid, Storage, Acquisition! – Illustration, Tom Miller

I regularly hear from solar installation companies that they sense complexity increasing in the industry.

Many are not sure what aspects of this complexity they can or should address, or how to do so. While the answer will depend on the strengths and positioning of each company, I thought it might be useful to describe the landscape in a somewhat uniform way.

Before I dive in, I want to thank Charlie Gay, current head of the DOE SunShot Program, for sharing his perspective and helping to distill an incredibly complex emerging field into a few key trends, as only he can.

Three Fundamentals

I think there are three fundamental contributors to the increase in complexity in solar, and each operates on a different timescale. The confluence of the three is the challenge we will need to deal with and plan for in the years ahead.

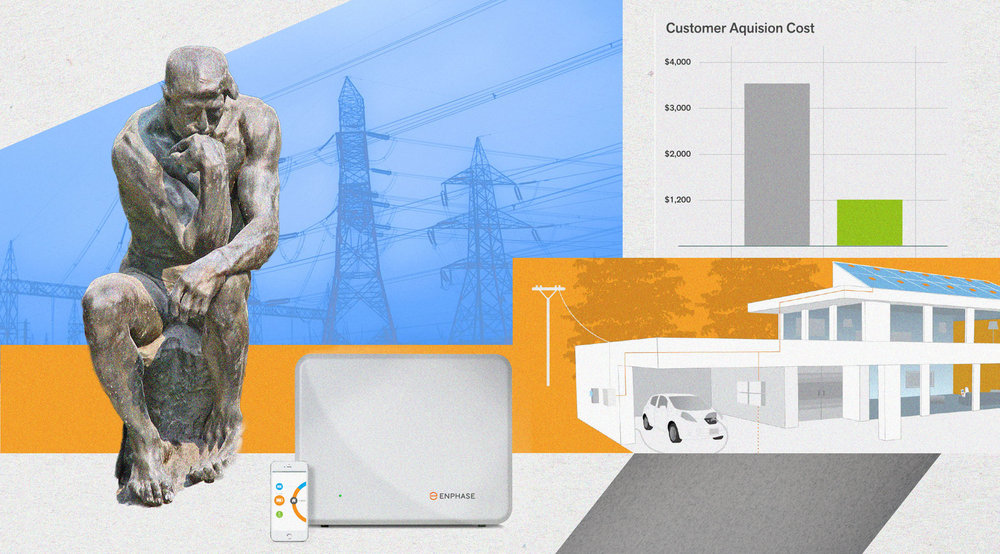

Complexity #1: Customer Acquisition and Financing

Timescale: 2016 – 2020

It is clear that, at least for the moment, national installation companies like SolarCity and Vivint Solar, who redefined customer acquisition and financing in the past three years, are in a phase of reinvention. While such companies contributed to the acceleration of industry growth, they did so at huge expense. The two main vehicles they used to drive this growth were aggressive (read: costly) customer acquisition and innovative financing.

“Installers reported that competition in the industry continues to build. Average quotes seen per customer increased from two to three, and more installers reported that customer acquisition

became more difficult in 2016 than in 2015.”

As the industry has matured, pressure to reduce customer acquisition costs and streamline financing has increased. Moreover, with market growth decelerating in key geographies like California, small and medium-sized installation companies have found it more challenging to keep their sales pipelines full.

Some solar-specialist financing companies are responding by attempting to increase revenue per transaction by supplying equipment to installers. Likewise, a wave of customer acquisition specialists of varying quality has emerged, including online marketplaces, telemarketing, and canvassing companies. Solar installation companies are looking outside their internal marketing organizations to source more leads and close sales. This comes with a range of quality issues.

Key takeaways:

- In the coming years, customer acquisition—including financing—needs to become simpler, and have more transparent intentions, for the industry to continue maturing. Installation companies will continue “storming” through this process, trying myriad options before sorting sustainable practices from fads.

- In my opinion, practices that prove most sustainable will be driven by end-user experience, quality, and empowerment—not by attempting to control the channel.

Complexity #2: Technical Complexity

Timescale: 2018 – 2023

Image, Enphase

Over the past five years, solar has become increasingly “plug-and-play.” All that is about to change. We might now think of solar as just one of many “technology categories” that will be specified and sold in concert, along with energy storage, home energy management, IOT, electric vehicles, smart home, and micro-grid/smart-grid. Accounting for each of these categories represents an exponential increase in the potential complexity of an energy system.

For more on this topic, watch/listen to Enphase CEO, Paul Nahi’s keynote address.

Energy storage appears to be the first of these “solar plus” technology categories to be broadly commercialized in the US. While market penetration in the US will be limited this year, we can look to Europe and Australia as examples and expect a steep increase in installations over the coming years. While manufacturers have taken different approaches to streamlining energy storage, systems today are still required to perform in use cases that include a still-evolving set of variables in terms of both usage and grid behavior.

For the installer, energy storage installations will require a higher level of training, the need for in-field tech support, and excessive truck rolls.

Understanding how storage fits into the PV installer’s business is compounded by the also-emerging categories listed above. How storage and consumption monitoring will interact with one another, let alone with bi-directional EV charging stations, will require waves of technological advancement achieving various stages of commercialization before new generations of centralized monitoring and controls become standard.

Solar installation companies can arm themselves to deal with this complexity in several ways.

Key takeaways:

- Company leadership must be clear on the capabilities needed to face emerging complexity and design the organization appropriately. As a simple example, if the capability to handle a more complex sales process is deemed high-priority, investing in sales training ahead of this need is advisable.

- Likewise, choosing carefully which complexity to adapt to—and when—will help the company remain focused. While early entrants into integrating IOT with solar (just an example) might carve out a market niche, the challenges of manufacturing quality issues, channel confusion, and labor overruns must be understood and anticipated.

- Another consideration—and this is more esoteric—is “hub” technology; that is, technology that will become the connecting point for PV, energy storage, consumption monitoring, etc. Effective hub technology might best be agnostic to the equipment connected to it (meaning one hub could interact with different types of inverters, appliances, etc.). Among mainstream solar technology companies, Enphase Energy is leading the way in this regard, as both a hub and spokes. Some hub specialists might be on the horizon.

Complexity #3: Grid Complexity

Timescale: 2018 – 2030?

While the timescale I’m applying here is somewhat arbitrary, I do think that we will only be able to see and evaluate utilities’ renewable energy strategy after the rate of change in technical complexity has plateaued (though there is arguably some chicken-and-egg stuff going on here).

Energy Grid- Image, Wikimedia

“Grid Complexity” refers to the ways in which grid-management strategies, mostly on the part of utility companies, respond to shifting generation and consumption dynamics, and it tends to wrap together both technical and economic factors.

The increase in solar grid penetration in some markets is causing utilities to take both technical and regulatory approaches in their response, and this response accounts for the economic impact of changing grid dynamics (on a utility or its constituents) as well as the actual flow of electrons throughout the grid. The well-known argument that solar generators don’t pay their fair share of transmission costs, coupled with elimination of net metering and implementation of time-of-use metering, which in turn necessitates and economically incentivizes energy storage, which will likely also cause additional changes in rate structures, reflects this complexity.

Utility rate design, from attacks on net metering in some states, to implementation of demand charges and time of use metering—or shifting time of use rates to new periods of the day—is one way grid management is becoming more complex. “Smart-grid” and “micro-grid” are to-be-defined vehicles for generation and transmission to be managed synchronously, which also have economic implications: (for example, is a kW/h worth less if it’s not on demand? How much less?)

Key takeaways:

- Solar installation companies need to be more aware than ever of utility and grid management objectives and be flexible in designing and installing systems that balance these objectives with end-users’.

- Furthermore, as renewable energy becomes more mainstream, solar providers need to understand that they are essentially “partnering” with the entities managing renewable energy distribution systems. And solar companies need to be open-minded in how the systems they deploy fulfill, and maintain, these partnerships.

Final thought: On Managing Complexity

In general, solar providers also need to include “managing complexity” in their strategic planning—which also implies that they need to take time out to do strategic planning. A relatively simple approach would be defining what aspects of complexity need to be addressed, and what “winning” might look like in addressing them.

Once you can paint of picture of what “winning” looks like, the next step is to define the capabilities needed in your organization in order to achieve that future state.

For example, if I am responsible for a solar contracting company, and I need to prepare for customer demand for energy storage systems because of the advent of time-of-use metering, I might define “winning” as “proving market acceptance for a cost-effective energy storage solution.” The subsequent capabilities I would define might include “trained personnel in sales, design, and installation, an updated product line card, an energy storage supply chain, and a financing partner who will fund energy storage projects.”

Obviously, you can go a lot deeper in strategic planning, but to clearly define a future state and needed capabilities to achieve it is a huge step.