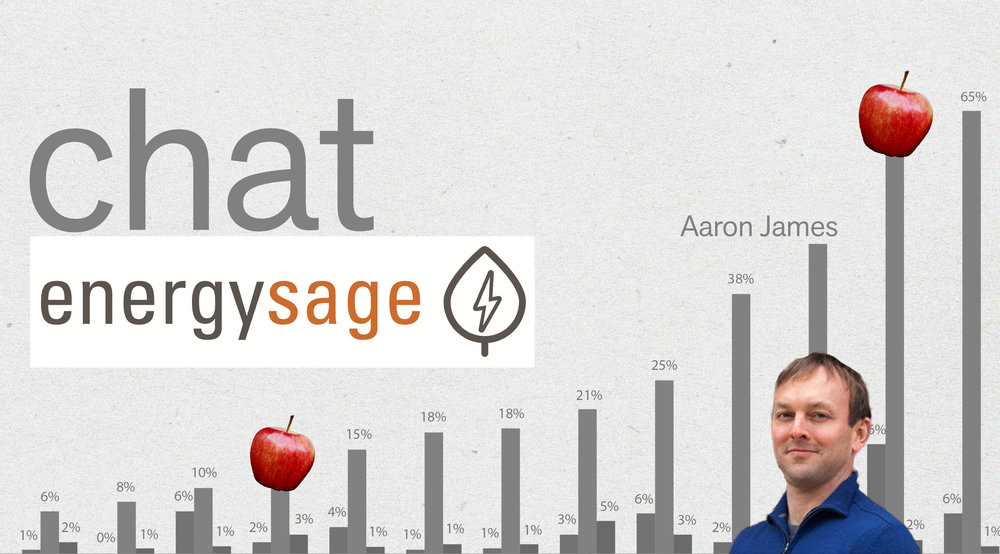

Today we’re chatting with Aaron James, VP of Network Partnerships at EnergySage. Aaron leads the company’s supplier network and marketplace support divisions. His decade of experience in clean energy spans project finance, program design, and quality assurance for residential and commercial installations.

This chat has been edited for clarity and length.

Tom: (Tom Miller – Editor, Solar r.e.view; Creative Director, BayWa r.e. Solar Systems): Hey Aaron, thanks for coming.

Aaron: Great to be here.

Tom: So who is EnergySage and what do you do?

Aaron: We’re the online marketplace for solar energy. We connect solar shoppers with prequalified companies who provide bids online. And we standardize those bids for the customers so they can review them in an apples to apples format. We’re all about transparency and choice for consumers, and we’re seen by folks in the industry as a great way to shop for solar.

Tom: So it’s kind of a managed sales process?

Aaron: Well, there are a lot of sales practices out there. Many involve knocking on people’s doors, or cold-calling them. And I think the industry has gotten a bad reputation for that. EnergySage gives the customer control over their own experience. Customers can register on our platform and share as much or as little information as they want. They can view bids from multiple installers and control the sales process at their own pace.

Tom: How many contractors do you have on your platform?

Aaron: We work with over 400 installers across 34 states and the District of Columbia.

Tom: Okay. Let’s talk about success on your platform. Are there certain factors that we can look at to measure success? Maybe jobs won? Or is there another metric we should use?

Aaron: Well, we might first measure consumer response and engagement. How often do customers respond to installers’ quotes and messages? And then, yes, we can look at who goes on and is selected with the winning bid.

I want to clarify that we are not a lead-gen company. We’re not your typical sales channel in many ways. People who are shopping on our platform are looking for a particular experience. They’re looking for prompt service, quick information up front, and controlling their own destiny. So the hard sell tactics that people use in other channels, those don’t work on EnergySage. It comes across as a little shallow. And the customers will say, “Okay, this company, who is kind of pushy, is not one that I want to work with.”

Tom: So having a more laid-back sales process is helpful?

Aaron: Yeah, and more attuned to the customer’s pace and interest. A consumer that registers on EnergySage says, “I’m in the market for solar, and I want solar quotes.” That’s the first level of interest, right? Responding to that interest means responding with a quote quickly, with a good proposal, and a friendly follow-up message. Maybe, “Here’s my offer. Looking forward to discussing with you. Let me know if there are things you want to change or discuss.”

Tom: Okay, great. But let’s back up a bit now. Where is the installer at this point? Maybe you can take me through the process of starting to work on the EnergySage platform?

EnergySage Solar Dashboard – Photo, EnergySage

Aaron: Yeah, sure. By this point, the installer has already signed up on our platform, passed our screening criteria, and decided to pursue customers in a particular territory. And those customer leads come into our system in real time and we pre-vet the properties to make sure they’re good candidates for solar.

So the installer gets a lead, they take a look at the property info, and they decide whether or not they want to pursue it. And they do that by opening up a quote online. The installer puts in their equipment information, financing—if they’re offering that—pricing, details about timing, and then presents that to the customer through our format. And what we do is allow consumers to see multiple quotes, side-by-side, in the same format.

Tom: So contractors are competing side-by-side, in an apples to apples format, like you said. I want to dig a little deeper into the competition topic, but before we go there, what does getting vetted on your platform look like?

Aaron: There’s a form that installers fill out with their license numbers, their certifications, and how long they’ve been in business. And then we take a look online to see what the company’s reputation looks like. So we check out Yelp, Facebook, Better Business Bureau, and others. And then we’ll have a call with the company to find out more about their background, where they are in the industry—geographically, in the value chain—and what equipment and warranties they offer the customer.

It’s not a vetting process like you would have with a financing company, where we’re looking at the company’s books and diving into their financials or anything like that. But we’re interested in making sure that they’re good companies, with high-quality equipment, and good quotes. The vetting is good for consumers and it also ensures that competition on our platform is fair. These are all high-quality companies providing quotes in the marketplace.

Tom: So let’s talk about competition. Who is winning jobs on your platform?

Aaron: So the companies who are winning jobs are quick to respond to consumers. They’re not pushy. They’re friendly. They’re happy to be competing! I think this is an interesting trait. Some companies want to be the only touchpoint for the consumer and try and bad-mouth the competition and squash other offers.

But the folks that succeed on EnergySage—they’re very happy competing. They’re happy that the customers are comparing offers and they’re beating the competition by saying, “This is why my offer is good. This is how I differentiate. Happy to have a conversation about how we’re different.” But they’re not speaking badly about competitors, which is an issue we’ve heard from the industry. When that happens, consumers get confused. That type of competition doesn’t work on our platform, because consumers are looking at multiple offers, side-by-side.

Tom: At our 2017 Partner Summit, Vikram Aggarwal, your CEO, said that one of the trends you’re seeing—based on the EnergySage 2016 Solar Installer Survey—was that competition is definitely increasing. Customer confusion was another thing he pointed out—that there is a lot of misinformation out there.

53% of respondents believe their competition is lowering consumer confidence – Data, 2016 EnergySage Installer Survey

Tom: What’s your take on what is healthy competition and what does EnergySage do to moderate that competition?

Aaron: I’ll give you our take, but I think there are lessons there for the whole industry. What we see is that because all the companies on our platform have been vetted, they all have a respect for their peers. And it helps that they know they’re not competing against someone who just started into solar last month, and is maybe offering equipment no one knows about or doesn’t have a track record with installation. These are all reputable companies with experience. You’re not competing with the bottom of the herd. And that also gives a lot of confidence to our program partners—corporations, non-profits, utilities in some cases—that are helping their members and employees go solar.

Tom: And you also standardize your format, which must help.

Aaron: Definitely. You can’t have healthy and fair competition unless consumers have information they can make sense of. On EnergySage, they can see multiple offers and know what they’re looking at. And it’s easier than scanning through PDFs from Aurora and Helioscope and any number of quote prep tools. Those are great tools, but they all make different assumptions, present information differently, and are very hard for consumers to compare.

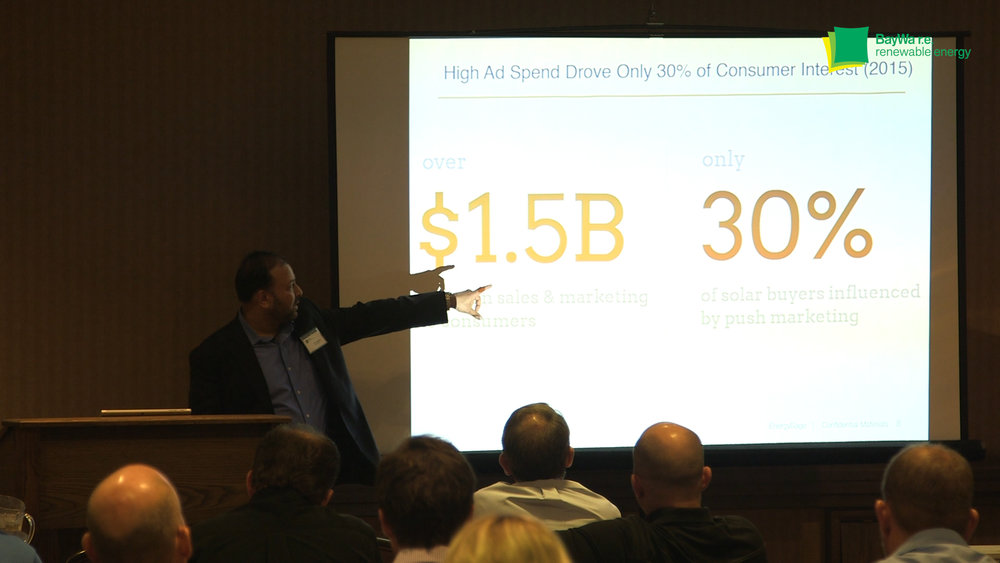

The top six publicly traded solar companies spent 1.5 billion on sales and marketing. Yet only 30% of consumers said that it influenced their decision to go solar. Photo, Tom Miller, from EnergySage CEO Vikram Aggawal’s 2017 BayWa r.e. Partner Summit presentation.

The top six publicly traded solar companies spent 1.5 billion on sales and marketing. Yet only 30% of consumers said that it influenced their decision to go solar. Photo, Tom Miller, from EnergySage CEO Vikram Aggawal’s 2017 BayWa r.e. Partner Summit presentation.

The last thing I’ll mention is that the customer controls the process. They decide who they want to share more information with, who to call, and who they want to invite to their home. Everyone has an even shot at that. And you can’t manipulate that with more marketing dollars.

Something we’ve seen in the industry at large is that big companies have spent ungodly amounts of money on their sales and marketing budgets, which can crowd out smaller installers as they take up online real estate with ads and a strong presence. Those companies can’t do that on EnergySage. So that definitely helps with fairness.

Tom: One criticism of the EnergySage platform that we hear from our customers, is that online marketplaces can drive margin out of contracts and reward “bad actors” selling at unsustainable prices. What is your response to this concern?

Aaron: When we started EnergySage, there was a lot of fear among installers about what people called a race to the bottom. The idea was that customers would just look for the lowest price, and sign on with the cheapest offer. It’s a reasonable concern, but the data suggests otherwise.

We’ve analyzed the results in the marketplace and found that most solar shoppers don’t pick the cheapest option. They’re searching for value, and willing to pay for it when they find it. It just has to be meaningful to them: a better installation company, a stronger warranty, better equipment.

The marketplace allows customers to see these things clearly and evaluate them relative to the prices offered. There will always be trade-offs, we just give the customer better information to make their decision faster. And if that transparency is scary to a solar company, then that company might not be the best fit for the marketplace.

We have several highly successful Sunpower dealers in our network, who sell only premium equipment at a premium price, and just crush it. We have companies who price higher and beat the competition through exceptional customer service. Price is only one factor in the equation.

According to the EnergySage Installer Survey, 70% of customers on the EnergySage platform do not select the lowest quote.

According to the EnergySage Installer Survey, 70% of customers on the EnergySage platform do not select the lowest quote.

I would challenge any residential solar company that thinks they’re competitive to try EnergySage. In some ways, this marketplace is an indication of where the overall market is headed. We’ve noticed a number of trends in our data before they’ve been recognized by the industry. And you can learn a lot by using this sales channel, even as a complement to other sources of volume.

Can you make a higher margin on a door-to-door sale with a naive homeowner who doesn’t have the tools to compare quotes? Sure. But how long is that market going to last? It’s been picked over by the bigger players with the bigger marketing budgets. We need to start focusing on where the market is headed. Scalable, efficient customer acquisition requires a better shopping process and a better customer experience.

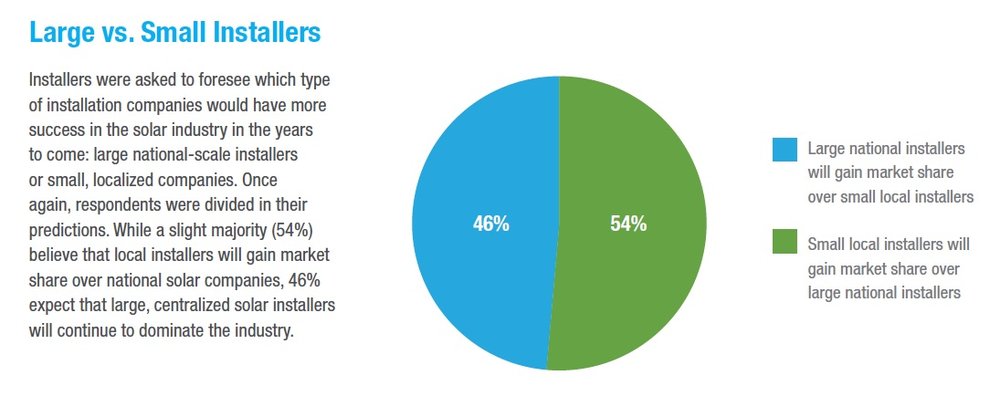

Tom: Vikram said your 2016 report shows the balance of power shifting towards the more local installer. How does your data represent that?

Aaron: Yeah, that’s a very interesting question. The first trend I’d highlight is the pullback on the marketing spend that I just mentioned. I think transparency of information also helps smaller, regional installers, given what we see from NREL. Just this weekend they published a report where they analyzed the data in our marketplace, as well as quotes outside of EnergySage.

They found that large installers were quoting prices at 10% more than what they called, “non-large.” In other words, small and medium.

Tom: Wow.

Aaron: Yeah. So for a consumer to know that they have a good price, they have to know how to interpret a solar quote. That can be tough, and standardizing helps that a lot. And it removes the ability for some of the bigger companies to use their market power to drive higher prices. For some consumers, there may be a benefit to going with a larger company, but then the question is: is it worth 10% more? Or thousands of dollars more? Many would argue not.

Who will gain market share? Data, EnergySage

Tom: As the contractors on your platform start to interact more with customers one-on-one, what else can they do to put their best foot forward? Do you have any other tips?

Aaron: It’s really a balance of listening and talking. And a balance of being an expert in your field, in the industry, but also being open to listing to the customer and adapting your solution to what the customer wants.

Tom: Can you expand on that?

Aaron: Sure. For example, some installers have been in the business a long time and they have strong options on how you do an installation, where you put it, and what makes sense. And that doesn’t always align with what a customer wants. Maybe they do want panels on their garage.

A good salesperson is really listening to the needs of the consumer all the way through the process and tailoring their offer—their pitch—to those needs. There’s a stereotype that a good salesperson is an extrovert, really talkative, maybe a little pushy. [Laughs] I think the salesperson who does best, especially with EnergySage consumers, is someone who balances their expertise with an ability to listen. And empathy for what the customer is going through!

Consumer-facing content – Photo, EnergySage

Tom: I want to quickly talk about content. EnergySage has a tremendous amount of content on your site. Can you give me a hypothetical example of how a contractor might use your content?

Aaron: Yeah, I would really encourage anyone not familiar with our content to check it out. For the most part, it’s all consumer-facing—easy to understand. But it still has a lot of depth. We were funded initially in part by the SunShot Initiative to develop the platform and there’s still an ethos of giving back. So it’s there for anyone to use and learn about solar.

And to your hypothetical: let’s say there’s an installer who is really focused on selling optimizers, or microinverters, or some piece of equipment. They can connect to all our content to demonstrate how microinverters are different from string inverters, for example. We can be a trusted third-party on that information.

We also have ratings on over 900 different panel models. So they can link to a specific panel on our website, including the spec sheet, but also more consumer-friendly content about that panel. In financing, we have articles about the different kinds of leases and loans. So there’s a lot of helpful information there.

Tom: Do you have any data on how the companies that work on the EnergySage platform are doing? Are they seeing an increase in revenue after working with EnergySage?

Aaron: [Laughs] You know, I see that anecdotally. I’m laughing because we should definitely do that analysis more systematically!

But we’ve helped companies grow three, four, five, times the revenue that they had prior to joining EnergySage.

And there are companies that have used EnergySage as one of their primary growth strategies. Particularly in residential. It’s very exciting to see someone do that kind of revenue on our platform. For some companies, we’re a smaller piece of their pie. But for others, we’re over half their revenue or more because they’ve chosen to grow with us, and dedicate their teams to this sales process.

Tom: Do you have any words of caution?

Aaron: Not really. But I would say to any company that’s just looking for a handful of leads—I’d ask them to think about if they really want to commit to this channel. Because the skills and techniques are slightly different than they might expect on another channel. And we work with all the companies on EnergySage to tailor their messaging and approach to the consumers who are attracted to this type of shopping. But it’s different.

Tom: Okay. Final question before we wrap up. What sort of time commitment are installers looking at to get up and running on your platform?

Aaron: We have training material that’s quick to absorb. We can get someone up to speed very quickly. The highly successful folks—I forgot to mention this earlier—they interact with our team a lot! They’re asking questions and getting follow up.

We work hard to help the consumers all the way to sale, and the installers all the way to sale as well. That’s where the collaboration comes in. And that’s where the bulk of the time is spent. The platform is easy, but really working with our team to find success over time—that’s where the dedication comes in.

Tom: Okay. Well thanks for taking the time today, Aaron! We really appreciate it.

Aaron: Yeah! Thanks for having me.